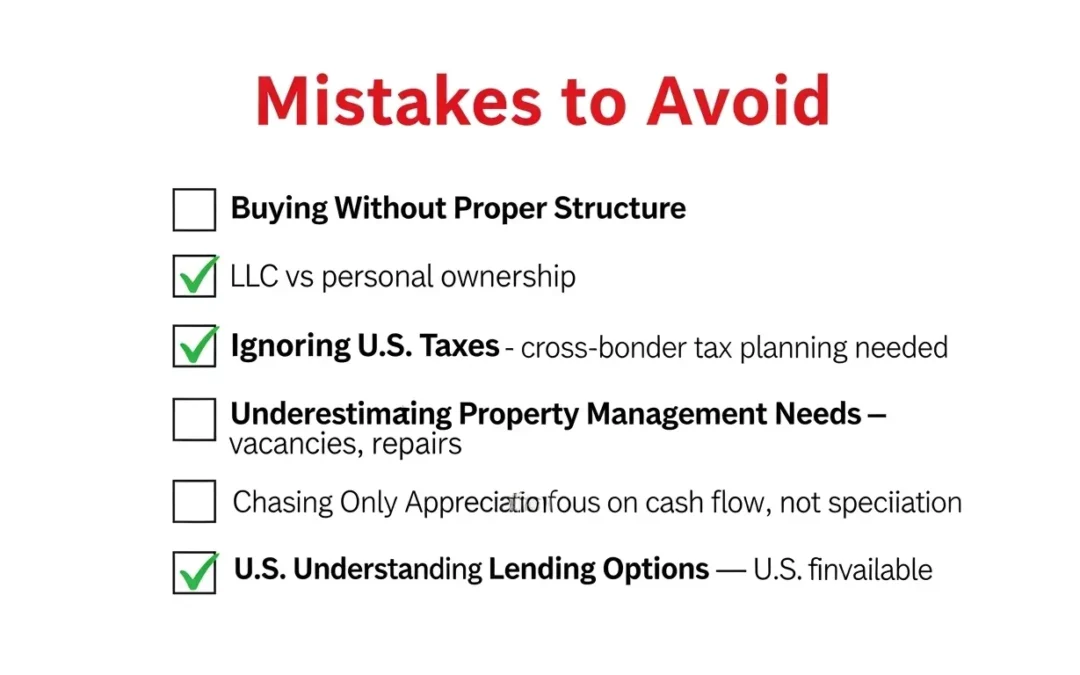

Investing across the border comes with incredible opportunities—but also some unique challenges. Here are the top mistakes Canadians make when investing in the U.S., and how to sidestep them:

1. Buying Without Proper Structure

Purchasing property personally instead of using an LLC or partnership can expose investors to unnecessary liability and create tax headaches. Always set up the right structure from the start.

2. Ignoring U.S. Taxes

Some investors assume taxes work the same as in Canada. Wrong. Failing to plan for U.S. (and Canadian) tax obligations can erode returns. Working with cross-border tax professionals is essential.

3. Underestimating Property Management Needs

Managing U.S. properties remotely is tough. Choosing the wrong property manager—or trying to DIY—often results in vacancies, missed rent, and costly repairs.

4. Chasing Only Appreciation

Canadian investors often look for the next “hot market.” In the U.S., sustainable returns come from cash flow. Avoid speculation and stick to fundamentals.

5. Not Understanding Lending Options

Canadians sometimes assume they can’t get financing in the U.S. That’s outdated thinking. Many lenders now specialize in working with Canadians.

Avoiding these mistakes can mean the difference between a frustrating experience and a profitable portfolio.